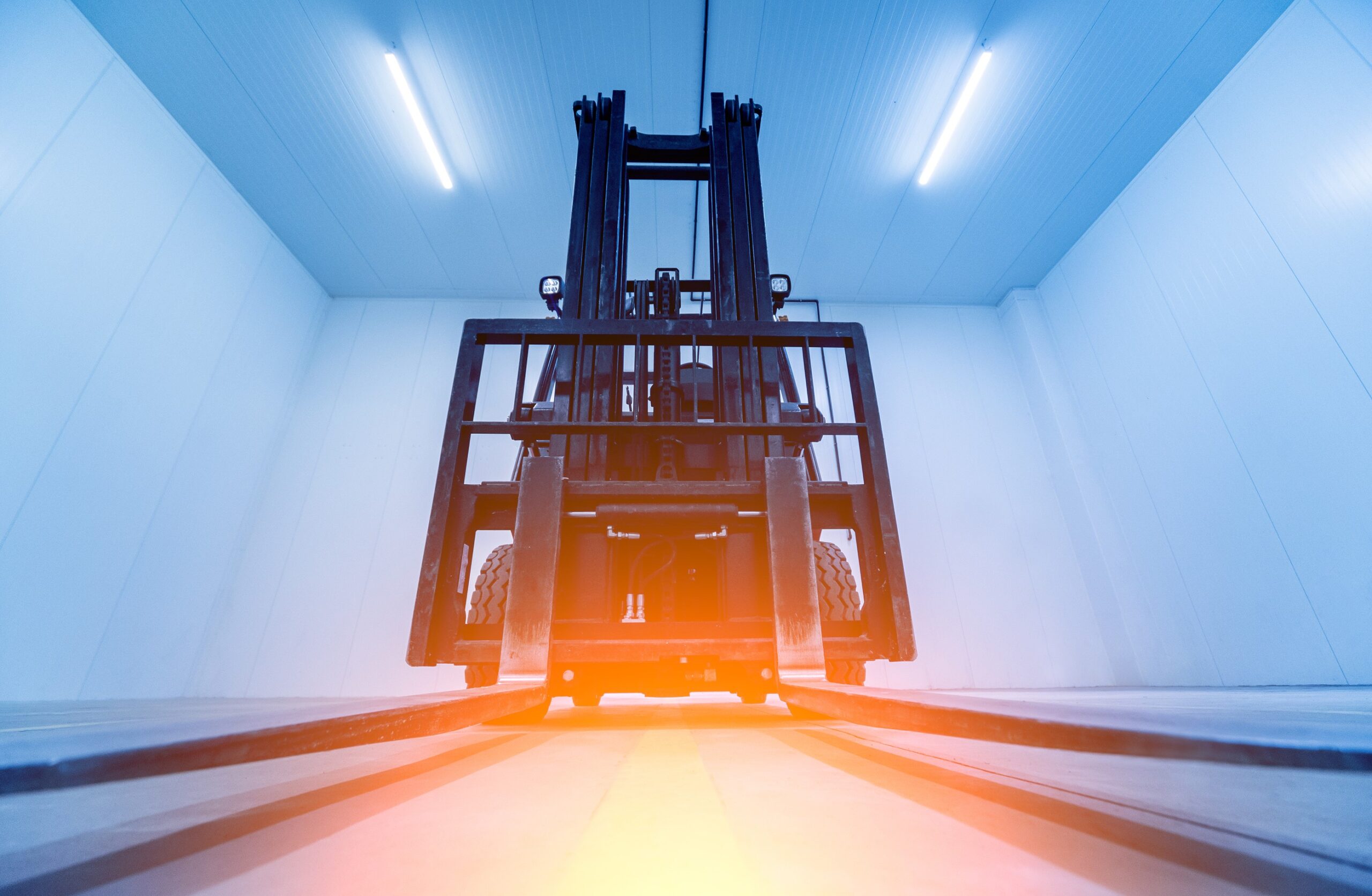

The Refrigerated Warehouse and Transport Association (RWTA) recently held its 79th conference and exhibition 2021. The theme of the conference was trade impacts on the Australian cold chain, COVID, agility and recovery in an era of uncertainty. Wiley’s Advisory Services Director Andrew Newby attended the conference again this year to join the conversation on changes in the industry.

The Australian landscape continues to change through acquisitions. The industry is dominated by the world’s largest Third Party Logistics (3PL) companies – Lineage, Americold and NewCold.

The industry has attracted the attention and investment from some of the Fortune 500 capital and real estate investors. The industry profile is generally long-term tenants with high capital investment in sites,meaning the tenancy is secure and attractive to investors.

The industry has gained a higher public profile during the COVID-19 pandemic as the public saw just how important the delivery of food was to supermarkets and retail outlets. On a global platform, the conference discussed the drivers of future growth and summarized in three points:

- Increased use of automation and robotics

- Increased demand

- Growth of e-commerce

With any opportunity there is also challenges. The challenges were summarized as:

- Driver shortage

- Balancing demand

- decrease in food service

- increase in retail

- Insourcing – customers who build their own cold store facility

Traditionally the cold storage sector has been an owner-occupier market. This has changed with Real Estate Investment Trusts (REITS) taking an interest and owning cold storage facilities from new, or investing in existing facilities with a lease-back. Some REITS who have traditionally invested in commercial property are investing more in logistics. 3PL companies who operate ambient warehouses can relocate easier than refrigerated warehouse 3PL companies. Refrigerated warehouses come with higher complexity and maintenance. Although the industry has felt the pain of insurance increases, increased energy charges and environmental compliance and is proportionally small in the overall logistics transaction volumes, it is attractive.

The retail end of the supply chain is also going through significant change, inevitable change accelerated by COVID-19. Swisslog presented the technology adopted for micro-fulfillment centres as on-line shopping replaces visits to supermarkets and walking aisles with a trolley.

COVID-19 amplified Australia’s lack of refrigerated storage capacity. The industry is hot for growth. When Australia is ranked against other countries, it is well below the average (refrigerated capacity (cubic metres) per urban resident. The average fell during 2016-2018 period. refrigerated warehouse space would need to be built. That is more than double the current volume.

Where there is strong investment interest providing funds, and a growing temperature sensitive food sector there is bound to be strong growth. Keep an eye on the cold-storage industry as it grows and adapts to this new environment.